How to Choose the Right Bookkeeper: An In-Depth Guide for Your Business

Finding the right bookkeeper can significantly impact your business’s financial health and overall success. Whether you’re considering a virtual bookkeeper or an in-house professional, it’s crucial to know what to look for and where to find them. This guide will walk you through the steps to find a bookkeeper that suits your needs, how much a virtual bookkeeper costs, and the benefits of virtual bookkeeping.

Key Takeaways

- Understanding the roles and responsibilities of a bookkeeper

- Tips on finding a virtual bookkeeper

- Cost considerations for virtual bookkeeping services

- Evaluating the worth of virtual bookkeeping for your business

What Does a Bookkeeper Do?

Before diving into how to find a bookkeeper, it’s essential to understand what a bookkeeper does.

A bookkeeper handles the day-to-day financial transactions of a business, including:

- Recording Sales: This involves documenting all sales transactions, including invoices and receipts, to ensure accurate revenue tracking and financial reporting. Proper sales recording helps businesses understand their income and monitor sales trends.

- Tracking Expenses: This task includes recording all business-related expenses, such as bills, purchases, and operational costs. By keeping an accurate account of expenses, businesses can manage their budgets effectively, identify cost-saving opportunities, and ensure timely tax reporting.

- Payroll Management: This involves calculating employee wages, withholding taxes, and processing payroll payments. Effective payroll management ensures that employees are paid accurately and on time, while also maintaining compliance with tax regulations and labor laws.

- Reconciling Bank Statements: This task involves comparing the company’s financial records to bank statements to identify any discrepancies. Regular bank reconciliation helps ensure accuracy in accounting, prevents fraud, and provides a clear picture of the business’s financial health.

How to Find a Bookkeeper?

When looking for a bookkeeper, start by assessing your business needs. Do you need someone full-time, part-time, or on a freelance basis? Here are some places to start your search:

- Online Job Boards: Websites like Indeed, LinkedIn, and Upwork are great places to find freelance or full-time bookkeepers.

- Professional Associations: Organizations like the American Institute of Professional Bookkeepers (AIPB) offer directories of certified bookkeepers.

- Referrals: Ask other business owners or your accountant for recommendations.

How to Find a Virtual Bookkeeper?

Virtual bookkeeping has become increasingly popular due to its flexibility and cost-effectiveness. Here’s how to find a virtual bookkeeper:

- Freelance Platforms: Websites like Upwork, Fiverr, and Freelancer have profiles of virtual bookkeepers with reviews and ratings.

- Bookkeeping Services: Companies like Bench, Bookkeeper360, and Belay offer professional virtual bookkeeping services tailored to small businesses.

- Social Media: LinkedIn and Facebook groups dedicated to accounting and bookkeeping professionals can be a good resource for finding virtual bookkeepers.

How Much Does a Virtual Bookkeeper Cost?

The cost of a virtual bookkeeper can vary widely based on their experience, the complexity of your bookkeeping needs, and whether you hire an individual or a service. On average, you can expect to pay:

- Hourly Rates: $8 to $15 per hour for a freelance virtual bookkeeper.

- Monthly Packages: $200 to $600 per month for services from a virtual bookkeeping company.

Factors to Consider When Hiring a Bookkeeper

Choosing the right bookkeeper involves more than just finding someone who can do the job. Here are some tips to ensure you find the best fit:

- Experience and Qualifications: Look for bookkeepers with relevant experience in your industry and proper certifications.

- Technology Proficiency: Ensure they are proficient with bookkeeping software like QuickBooks, Xero, or FreshBooks.

- Communication Skills: A good bookkeeper should communicate clearly and be responsive to your needs.

- References and Reviews: Check references and read reviews from previous clients to gauge their reliability and performance.

Is Virtual Bookkeeping Worth It?

Virtual bookkeeping offers several benefits, including:

- Cost Savings: Virtual bookkeepers often cost less than in-house staff due to lower overhead costs.

- Flexibility: You can scale services up or down based on your business needs.

- Access to Expertise: Virtual bookkeeping services often employ teams of experts, providing a higher level of knowledge and experience.

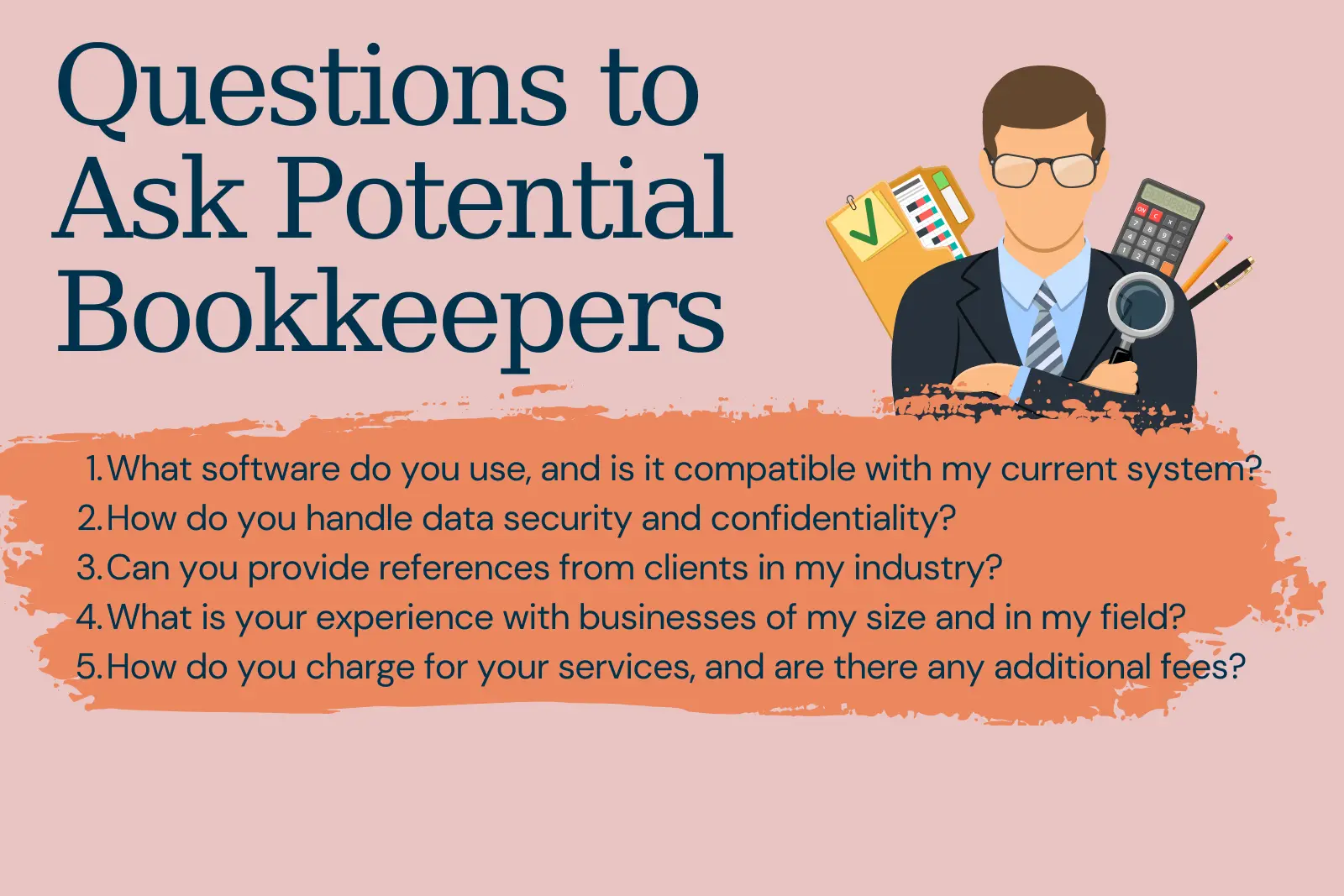

Questions to Ask Potential Bookkeepers

When you’re ready to hire a bookkeeper, asking the right questions can help ensure you choose the best fit for your business. Here are some key questions to consider:

1. What software do you use, and is it compatible with my current system?

Importance: Ensures seamless integration of your financial data and minimizes operational disruptions.

2. How do you handle data security and confidentiality?

Importance: Protects sensitive financial information and maintains compliance with privacy regulations.

3. Can you provide references from clients in my industry?

Importance: Validates their experience and expertise in your specific sector, ensuring they understand your unique needs.

4. What is your experience with businesses of my size and in my field?

Importance: Confirms they have relevant experience, which can lead to more tailored and effective bookkeeping solutions.

5. How do you charge for your services, and are there any additional fees?

Importance: Provides transparency in pricing, allowing you to budget accurately and avoid unexpected costs.

Evaluating Your Bookkeeper’s Online Presence

It’s essential to check the online presence of your virtual bookkeeper before hiring. This gives you a good idea about their professionalism and how they present themselves to potential customers:

- Website Design: A well-designed, easy-to-use website reflects professionalism.

- Social Media Activity: Active social media accounts with regular postings indicate engagement and reliability.

- Client Reviews: Positive reviews from other clients can be a good indicator of the quality of service.

Does Your Virtual Bookkeeper Have Experience in Your Industry?

Industry-specific experience is crucial as it ensures the bookkeeper understands the unique financial needs and challenges of your business. Check their website for mentions of expertise in your field and ask for references from similar businesses.

Learn Their Process for Dealing with Clients

The best virtual bookkeeping services have a well-crafted procedure for dealing with clients. This process should include:

- Initial Consultation: Discuss your business requirements and expectations.

- Customized Plan: The bookkeeper should create a plan tailored to your specific needs and budget.

- Implementation and Review: They should implement the plan and regularly review it to ensure it meets your expectations.

Ask Your Virtual Bookkeeper About Deliverables

Ensure your bookkeeper provides accurate and up-to-date financial statements, including profit-loss statements and balance sheets. These documents are essential for tracking your company’s financial health.

Ask About Pricing

Bookkeeping is an essential service for your business, but it can be costly. Ask about the pricing structure and any hidden costs. Compare quotes from different bookkeepers to ensure you get the best value for your money.

Conclusion

Finding the right bookkeeper, whether virtual or in-house, is a critical step in managing your business’s finances effectively. Amazing VA Partners simplify your trouble in finding the right bookkeeping virtual assistant by considering your specific needs, researching potential bookkeepers thoroughly, and understanding the costs involved. This ensures you find a bookkeeper who will help keep your financial records in order and support your business growth.

Ready to find the right bookkeeper for your business? Contact us today to learn more about our virtual bookkeeping services and how we can help you manage your finances efficiently and effectively.

About the author

How do I ensure my financial data is secure with a virtual bookkeeper?

To ensure your financial data is secure, ask potential bookkeepers about their data protection measures, including encryption and secure storage practices. It’s also important to review their policies on confidentiality and data sharing.

Can a virtual bookkeeper help with tax preparation?

Yes, many virtual bookkeepers are qualified to assist with tax preparation. They can help you organize your financial records, ensure compliance with tax regulations, and prepare necessary documents for filing. However, it’s essential to confirm their expertise in this area before hiring.

What questions should I ask during the hiring process?

When interviewing potential bookkeepers, consider asking about their experience with your industry, the software they use, their process for handling client relationships, and how they manage deadlines. Additionally, inquire about their pricing structure and any hidden fees.

To ensure your financial data is secure, ask potential bookkeepers about their data protection measures, including encryption and secure storage practices. It’s also important to review their policies on confidentiality and data sharing.

Yes, many virtual bookkeepers are qualified to assist with tax preparation. They can help you organize your financial records, ensure compliance with tax regulations, and prepare necessary documents for filing. However, it’s essential to confirm their expertise in this area before hiring.

When interviewing potential bookkeepers, consider asking about their experience with your industry, the software they use, their process for handling client relationships, and how they manage deadlines. Additionally, inquire about their pricing structure and any hidden fees.